Think 7.5% Inflation Was Bad? How About FLEXIBLE Core Inflation At 19%! (2-year Treasury Yield Skyrocketing Along With Mortgage Rates) – Confounded Interest

I thought the last inflation report of 7.5% inflation was bad. But then the Atlanta Fed updated their inflation measure for flexible prices. Flexible inflation, less food and energy, is roaring at 19% YoY!

Flexible prices are those prices that adjust rapidly. Along with commodity prices.

Speaking of rapid rises, take a look at the 2-year US Treasury yield since COVID struck in early 2020.

We did see 2-year Treasury yields generally correlated with The Fed Funds Target Rate … at least until COVID struck. Since mid-2020, The Fed Funds Target Rate remains at 0.25% while the 2-year Treasury yield is roaring back with fuzzy expectations from The Fed’s leadership.

The 10-year Treasury yield is not rising as rapidly as the 2-year Treasury yield, but it is hovering around 2%.

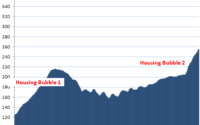

But Bankrate’s 30-year mortgage rate is rising like a comet, similar to the 2-year Treasury yield.

Rapidly rising inflation may cause anxiety attacks. Here is a cure: an emotional support honey badger!

[ad_2]

Source link