How the Fed lost the plot

Do you remember Goldilocks? It’s unlikely we’ll be hearing much about that fairy tale character anytime soon. For Jay Powell, the US Federal Reserve President, the US economy will most likely get too hot or too cold, or go from one to the other. Unlike the 1990s, or even most of the last generation, it would be rash to bet on a soft landing for the US economy. The era of easy money was also one of relatively easy central banking. That job is getting much harder. Goldilocks has left the building.

Some of the Fed’s problems are of its own making. Its main sin has been illusion, a trait that the markets also shared. The Fed has yet to explain why it got it so wrong on inflation in the last year. For most of 2021, the Fed insisted that higher inflation was “transient,” even as evidence mounted that it was not. Then, in November, the Fed went on to admit that the problem was more complicated than it thought. But he didn’t act like he meant it. It took him another four months to end his $40 billion monthly injection into an already booming real estate market.

Even after heralding a turn in the interest rate cycle, the Fed signaled the change would be modest. Its first interest rate increase of 25 basis points came in March, months after inflation began to exceed its 2 percent target. In fact, real monetary conditions have gotten easier since then. Inflation has risen more than the fed funds rate, making the US real interest rate even more negative than before. It’s as if Powell, re-elected Fed chairman, can’t bring himself to let go of Goldilocks’s hand.

It’s hard to blame him. For decades, markets have thrived on the one-way bet that when conditions got tough, the Federal Reserve would prop up asset prices with deep rate cuts and quantitative easing. Therefore, it always made sense for investors to “buy the dip.” Even when the Fed complained that it was the only game in town, in frustration with the fiscal gridlock that crippled Washington for most of the post-financial crisis years, it played on. Not having done so would have been much worse for everyone. But the super-rich have been the overwhelming beneficiaries, which has not been healthy for democracy.

On the one occasion the Fed tried to alter the rules, it quickly came online. Ben Bernanke’s attempt to end quantitative easing in 2013 was thwarted by the market’s “gradual tantrum”.

A few months after Covid-19 hit, the Fed replaced its strict 2 percent inflation target with much more fungible language. Almost everyone, not just the Fed, was converted to the view that the US economy could function much more than theory dictates in the interest of full employment.

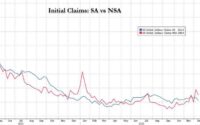

Unfortunately, that position has now been discredited. It turns out that inflation is still a death eater of income gains. In addition to rapid wage growth, China’s addiction to “zero Covid” lockdowns and the war in Ukraine are likely to sustain inflation across a wide range of goods for months. While the Fed can do nothing to alleviate global supply chain problems, the risk is that it will have to overcompensate for its failure to tackle inflation sooner. On Wednesday, Powell is likely to announce the first 50 basis point hike in years. That is already included in the price. But with headline inflation running at 8.6 percent, doubling the federal funds rate to 1 percent is hardly disinflationary.

This underscores two growing threats to the Fed. The first is that it might be forced to induce the US. recession with much higher interest rate increases than you now anticipate. The Fed’s latest dot plot predicts a rate of 1.9 percent by the end of this year. In the past week Deutsche Bank predicted the Fed would have to raise that rate to 5 or 6 percent to control inflation. For similar reasons, Morgan Stanley warned that the US was entering a bear market. Both points of view are minority. But consensus forecasts, including the Fed’s, have been so bad that it would be unwise to take most of them literally. The revival of the middle-class wagon may prove fleeting.

The second concern is about damage to the Fed’s credibility. Powell did not acknowledge that inflation was not transitory until President Joe Biden reappointed him. No doubt this was a coincidence. Either way, the institution that until recently was seen as the most effective in Washington may be forced to relearn the lessons of the 1970s and early 1980s, even if today’s problems are not so great. Credibility is bought at great cost over a period of years. Unfortunately, it can also be risked remarkably easily.

edward.luce@First Faq.com

[ad_2]

Source link