US Manufacturing Slumps In May, New Orders & Jobs Contract

Analysts expected Manufacturing PMI to be flat from its ugly preliminary print of 52.4 and saw ISM Manufacturing dropping to 54.5 from 56.1 – both still comfortably in expansion (above 50) despite the collapse in US macro data relative to expectations.

BUT… things improved intra-month for Manufacturing PMI – rising to 52.7 final from 52.4 preliminary – but still notably below April’s 57.0 print.

ISM Manufacturing was worse, falling to 53.0 from 56.1 (below the 54.5 expectations).

Source: Bloomberg

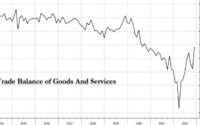

The headline PMI dropped to its lowest level since July 2020 amid a near-stagnation of factory output and a fall in new orders. The decrease in sales was the first since May 2020, with domestic and foreign client demand falling.

The ISM print is the weakest since June 2020 and under the hood is more worrisome with an outright contraction in new orders and employment…

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The PMI survey has fallen in June to a level indicative of the manufacturing sector acting as a drag on GDP, with that drag set to intensify as we move through the summer. Forward-looking indicators such as business expectations, new order inflows, backlogs of work and purchasing of inputs have all deteriorated markedly to suggest an increased risk of an industrial downturn.

“Demand growth is cooling from households amid the cost-of-living crisis, and capital spending by companies is also showing signs of moderating due to tightening financial conditions and the gloomier outlook. However, most marked has been a steep drop in orders for inputs by manufacturers, which hints at an inventory correction.

“Some welcome news is that the drop in demand for inputs has brought some pressure off supply chains and calmed prices for a wide variety of goods, which should help alleviate broader inflationary pressures in coming months.”

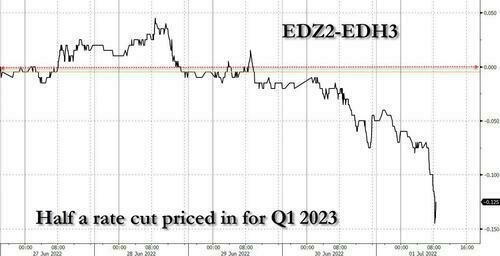

So, even though the manufacturing surveys are still above the 50 Maginot Line, the steep declines sync positively with the rising recession fears and soaring rate-cut expectations being priced into the markets…

Will Powell jawbone that expectation away, or embrace it as policy?

[ad_2]

Source link