Biden’d? US Mortgage Applications Hit Lowest Level In 22 Years (Purchase Apps DOWN -21% YoY, Refi Apps DOWN -83% YoY As Fed Tightens To Combat Bidenflation) – Confounded Interest – Anthony B. Sanders

US mortgage applications just hit the lowest levels in 22 years, January 2000 as The Federal Reserve continues monetary tightening to combat Bidenflation.

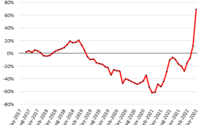

Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 19, 2022.

The Refinance Index decreased 3 percent from the previous week and was 83 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 21 percent lower than the same week one year ago.

Notice that The Federal Reserve is slower than the Geico Sloth is removing balance sheet stimulus.

MBA mortgage applications just declined to their lowest level in 22 years (January 2000) as The Fed has begun raising rates to fight inflation caused by 1) excessive monetary stimulus since late 2008, 2) Biden’s green energy policies driving up transportation costs, 3) distortionary Federal spending (e.g., Covid relief, infrastructure bills and now green energy/IRS spending by Biden/Pelosi/Schumer).

Here is the data summary for the latest MBA applications report.

Fed Chair Jerome Powell shrinking The Fed’s balance sheet.

[ad_2]

Source link