Did The BoJ Just Blow $50 Billion For Nothing…

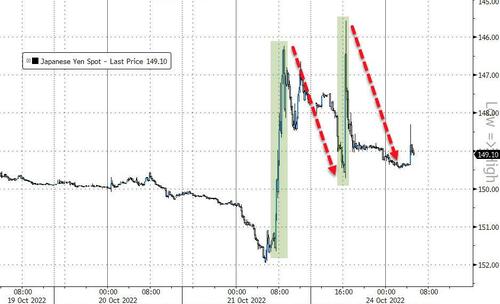

Sunday night’s FX market open saw another ‘interventionesque‘ surge in the yen relative to the dollar as Friday’s 6 handle surge and purge rebounded.

However, 12 hours later this latest attempt to manipulate markets has already been erased.

That was Strike 4 and 5 for the Bank of Japan’s efforts to save its ailing currency.

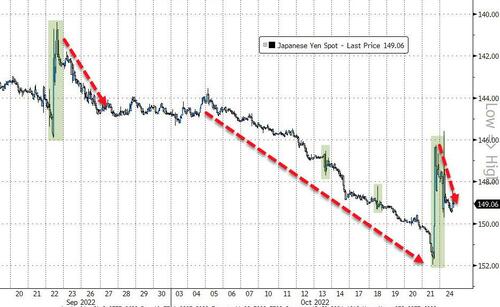

As a reminder Strike 1 was on September 22…

Strike 2 was just last week…

That is strike 3 for yentervention.

The choices before Japanese policy makers are stark:

-

either relax the yield-curve control framework;

-

or be willing to yen the weaken.

while there clearly have been interventions, their half-lives are measured in hours if not minutes.

Indeed, as Bloomberg’s Ven Ram notes:

“there is no third choice really at a time when inflationary pressures in the US are likely to compel the Fed to keep going and causing inflation-adjusted yield differentials to move in favor of the dollar against the yen. “

And as Bloomberg reports this morning, the costs of these efforts are starting to add up.

The size of the suspected market action is estimated to be as much as 5.5 trillion yen ($36.8 billion), according to a basic calculation using the BOJ’s forecast for the change in its current account and the Central Tanshi projection for the balance assuming no intervention.

Add to that the likely magnitude of last night’s Strike 5 intervention and one could easily argue The Bank of Japan has puke $50 billion in these attempts… and what have they achieved – a 3 handle increase in Yen relative to the dollar….

Nobuyasu Atago, chief economist at Ichiyoshi Securities and a former BOJ official, said his impression was the government spent more than 4 trillion yen on late Friday to support the yen and about 2 trillion yen this morning again to boost the yen.

“We have a system in place to monitor the market 24 hours a day, 365 days a year, truly 24/7, any time, any place and to carry out the necessary response,” against speculative trading, Masato Kanda, the top currency finance ministry official told reporters Monday.

“High volatility creates a serious problem for the Japanese economy, companies and households.”

Since the first intervention in September, things have not gone well.

Wasn’t it Einstein that said the definition of insanity is trying the same thing again and expecting a different outcome?

It appears Japanese policymakers have confirmed what many market participants have long believed about their extreme actions…

[ad_2]

Source link