Quantitative buybacks = quantitative easing

Fed Guy/Joseph Wang/10-31-2022

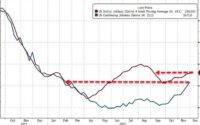

“A Treasury buyback program today would be mechanically equivalent to quantitative easing and a tailwind for risk assets. Buybacks funded by bill issuance would move cash out of the RRP and into the broader financial system. The end result would be an increase in cash held by banks and non-banks, both whom may rebalance their portfolios into other assets. In addition, the reappearance of a steady bid for coupon Treasuries would put downward pressure on yields and boost market liquidity. This post shows why buybacks would be mechanically equivalent to QE, reviews two channels QE operates to boost risk assets and suggests a potential shift in the conduct of monetary policy.”

USAGOLD note: You may have seen the headlines that the Treasury Department is considering stepping into the Treasuries market as a buyer of long-term debt and a seller of short-term debt – a head-scratcher for most investors. Wang, a former senior trader on the Fed’s open market desk, delves into its real meaning calling it “an important departure in how monetary policy is conducted.” The program would amount to launching a new form of quantitative easing disguised as yield inversion control.

USAGOLD note: You may have seen the headlines that the Treasury Department is considering stepping into the Treasuries market as a buyer of long-term debt and a seller of short-term debt – a head-scratcher for most investors. Wang, a former senior trader on the Fed’s open market desk, delves into its real meaning calling it “an important departure in how monetary policy is conducted.” The program would amount to launching a new form of quantitative easing disguised as yield inversion control.

[ad_2]

Source link