Financial Times/Eric Platt, Kate Duguid,Tommy Stubbington, Jonathan Wheatley and Leo Lewis/12-6-2022

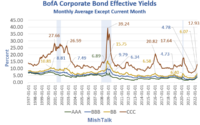

“Soaring inflation is being met by rising interest rates, the slowing of central bank asset purchases and fiscal shocks, all of which are sucking liquidity, the ability to transact without dramatically moving prices, out of markets. Violent, sudden price moves in one market can provoke a vicious loop of margin calls and forced sales of other assets, with unpredictable results.”

USAGOLD note: It’s all about liqidity, or better put the lack of it, and how it might affect global bond markets in the event of a crisis. Financial Times does a good job of exposing the dangers lingering in the financial system at the link. Highly recommended. It seems like the warnings of meltdown and contagion effect from mainstream media sources are at a level not seen in the past. For the average investor, these analyses point to potential black swans swooping in from multiple directionsand perhaps at a level of intensity never seen before, as Nouriel Roubini has recently warned. Best to have a hedge in place before, not after, the event[s].

USAGOLD note: It’s all about liqidity, or better put the lack of it, and how it might affect global bond markets in the event of a crisis. Financial Times does a good job of exposing the dangers lingering in the financial system at the link. Highly recommended. It seems like the warnings of meltdown and contagion effect from mainstream media sources are at a level not seen in the past. For the average investor, these analyses point to potential black swans swooping in from multiple directionsand perhaps at a level of intensity never seen before, as Nouriel Roubini has recently warned. Best to have a hedge in place before, not after, the event[s].