CBO Estimates US Treasury Default As Early As July

While Janet Yellen continues to ‘hope’, the nonpartisan Congressional Budget Office is out with its first public opinion on the risk of default by the US federal government if lawmakers fail to raise the debt ceiling.

“If the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be exhausted between July and September 2023,” the CBO estimated.

More ominously, they warn that lower tax receipts could bring the ‘x date’ even closer…

The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.

In particular, income tax receipts in April could be more or less than CBO estimates.

If those receipts fell short of estimated amounts – for example, if capital gains realizations in 2022 were smaller or if U.S. income growth slowed by more in early calendar year 2023 than CBO projected – the extraordinary measures could be exhausted sooner, and the Treasury could run out of funds before July.

CBO concludes that if the debt limit was not raised or suspended, the Treasury would not be authorized to issue additional debt other than to replace maturing securities.

That restriction would ultimately lead to delayed payments for some government activities, a default on the government’s debt obligations, or both.

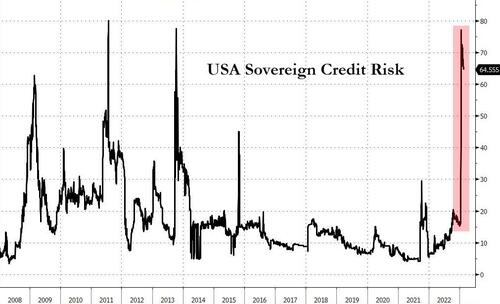

The credit market continues to worry about the chance of a USA sovereign default (or devaluation)…

Source: Bloomberg

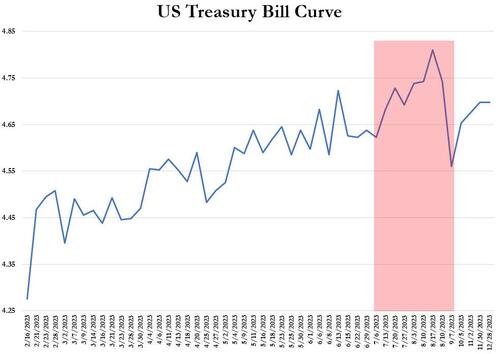

And the Treasury Bill curve is ‘kinked’ in that July-to-September period…

And while it appears the Bill market sees a return to normal after the game of chicken is complete in late Summer, we note, in a different more broad report, CBO projects something a lot more ominous…

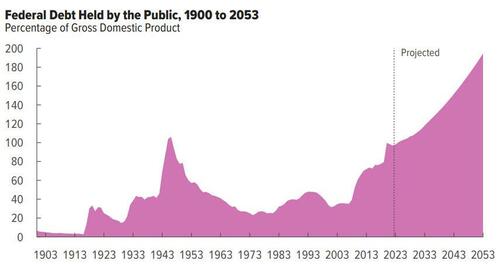

Federal debt held by the public is projected to rise from 98 percent of GDP in 2023 to 118 percent in 2033 – an average increase of 2 percentage points per year. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt.

Those factors persist beyond 2033, pushing federal debt higher still, to 195 percent of GDP in 2053.

So expect a lot more ‘debt ceiling debacles’ to come… or end of the dollar hegemony at some point.

Loading…

[ad_2]

Source link