The Forces Upending the Global Economy Cannot be Reversed

So sorry, but the lifestyle of low-cost credit and all the goodies it could buy is permanently out of stock.

In focusing on geopolitics, we lose sight of the dependence of every economy on a functioning global economy

of low-cost goods, services, materials, shipping, transport, capital, labor and financial instruments, all flowing

freely across borders and around the world.

Russia, China, the U.S., and indeed every economy are equally dependent on access to a functioning global economy

to obtain essential goods, services and capital and sell surplus production.

The irony here is the “poor” subsistence villagers with very limited access to global markets will manage the

breakdown of the global economy far better than the “wealthy” urban dwellers who are totally dependent on free-flowing

global trade. (The villagers will be frustrated by spotty cell service; the urban dwellers will be hard-pressed to

obtain enough food and fuel to survive.)

What few seem to realize (or acknowledge) is the forces already in motion will upend the global economy, and there

is no reverse gear. These forces are:

1. De-globalization

2. De-financialization

3. Real-world scarcities that cannot be overcome with financial trickery.

4. Diminishing returns on what worked in the past: financial stimulus and other trickery.

5. Asymmetries that can no longer be papered over.

Each of these forces is multi-faceted and complex. Each has the unstoppable momentum of cause and effect.

The financial trickery of the past 30 years has created a delusional faith that there are no real-world scarcities

or difficulties that can’t be resolved with some new financial stimulus or gimmick. This is a compelling delusion,

for we all want magic that makes the real world do what suits us.

The central delusion is that “money” (credit/currency) from somewhere can magically extract as many materials and

goodies as we want from somewhere else. This is hyper-globalization and hyper-financialization in a nutshell:

hyper-financialization is the global commoditization of credit, leverage and trickery, enabling the vast expansion

of credit, leverage and trickery which has fueled the astounding expansion of speculative frenzy which is now the engine

of the global economy.

Hyper-globalization is the fulfillment of the neoliberal fantasy that commoditizing self-regulating (ha-ha, you

mean cartels and monopolies, correct?) markets would permanently lower costs and expand credit, consumption and prosperity.

In this hyper-version of global trade (which has existed for thousands of years), the mass commoditization of credit and

capital flowing freely around the world, plucking (and exploiting) the most profitable opportunities wherever they

might be (luxury resort in Timbukthree, count us in, at least until we can find a sucker to buy our commoditized debt

instruments) will all by itself lower costs and boost production and consumption forever.

Nice, but financial trickery eventually runs into real-world constraints and asymmetries it cannot resolve.

Once the cheap-to-get resources have been depleted, it costs more to extract, process and transport them, even with

technological advances.

Other constraints are economic, political and social in nature. Local populaces eventually realize their

resources are being plundered by corporations from afar who arbitrage vast asymmetries in the cost of capital, labor costs,

environmental standards and currency valuations (to name a few) to stripmine locals and leave them the “dividends”

of hyper-globalization and hyper-financialization such as polluted wastelands and unpayable debts.

Nations eventually awaken to the risks of becoming dependent on others for essentials, and so onshoring,

friend-shoring and reshoring all become national-defense policies, never mind the corrupting neoliberal fantasies of

everyone singing Kumbaya around the hyper-globalization and hyper-financialization campfire.

Creating a billion units of currency doesn’t automatically conjure up a billion units of fresh water, wheat or oil.

When there were unexploited reserves of these essentials, then massive infusions of capital from somewhere else

could fund their extraction, but when the easy-to-get reserves have been depleted, then cheap capital doesn’t translate

into cheap goodies.

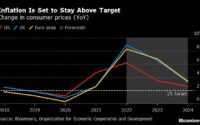

The reversal of these forces has a funny consequence which we call inflation. Let’s start by setting aside

economic fantasies such as “inflation is always a monetary phenomenon.” If a primary source of oil happens to be blown

to bits and oil jumps $50 a barrel overnight, costs will rise in a manner that has nothing to do with the expansion or

contraction of the money supply. “Inflation” is simply this: a unit of labor / currency buys fewer goods and services,

or buys goods and services of lower quality.

However you wish to put it, labor and money lose purchasing power: each unit of labor/currency buys less than it did in

the past.

Inflation has many sources, but let’s focus on the reversal of hyper-globalization and hyper-financialization.

The reversal of financialization increases the cost of capital (interest rates, cost of mitigating rising risk) and

the reversal of globalization increases the costs of goods and services.

The global realities of depletion and scarcity also push costs higher.

Simply put, each of these forces is highly inflationary as a matter of cause and effect. There is no

way to conjure a hat-trick of financial gimmicks to reverse these forces of higher costs, i.e. inflation: every unit

of labor and currency buys less than it did in the past.

Authorities have been trained by the golden decades of abundance and low costs to do more of what worked in the

past, i.e. financial stimulus of one kind or another. Just flood the land with credit and currency, and

the magic will fix whatever is broken or hobbling.

But the returns on these artifices have diminished to the point that the gimmicks are not just failing, they

are actively making the problems worse. Thanks to the globalization of “The Fed Put,” moral hazard is now

the context of every global financial decision. Financial stimulus inflates speculative bubbles, which inevitably pop,

generating waves of distress which additional waves of financial stimulus only accelerate.

The notion that speculative bubbles can painlessly fuel abundance and prosperity is bankrupt, and the collapse of

this appealing delusion will collapse the entire global structure of hyper-financialization.

In a delicious irony, stimulus in any form is now inflationary. Doing more of what worked in the past

will now accelerate the “problem” central banks and governments are trying to solve: inflation. This reality drives

a stake through the heart of all the hopes that doing more of what worked in the past will magically work,

even as it adds fuel to the bonfire of higher costs.

Lastly, there is a broad spectrum of destabilizing asymmetries which can no longer be papered over with gimmicks.

These include (but are not limited to) profound asymmetries in risk premiums, liquidity and valuations, resource reserves,

political stability, dependencies on global markets for buyers of last resort and so on.

The bottom line is there are few if any nations that could survive intact should hyper-globalization and hyper-financialization collapse and scarcities increase. As I explained in

Weaponizing Global Depression, real-world resources and financial, poltical and social systems that are

transparent and adaptable are the necessary foundations for the shift from dependence to self-reliance.

So sorry, but the lifestyle of low-cost credit and all the goodies it could buy is permanently out of stock.

The banquet of consequences is being served even if no one has the appetite for what is about to be forced down

their throats by constraint, asymmetries and cause-and-effect.

New Podcast:

Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ (53 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Neil C. ($108), for your outrageously generous contribution |

Thank you, Simon K.W. ($80 HK), for your marvelously generous contribution |

[ad_2]

Source link