Deutsche Bank Now Under Fire

Submitted by QTR’s Fringe Finance

Yesterday’s rally was a little stunning to me, despite the fact that Janet Yellen hurriedly changed her tune from Wednesday regarding FDIC deposit insurance. Zero Hedge wrote on Thursday:

One day after her prepared remarks to the Senate Financial Services Committee sent stocks plunging when she said that she had neither considered nor examined the possibility of expanding federal insurance temporarily to all US bank deposits without congressional approval – as such a move would require legislation, although regulators were prepared to repeat depositor rescues if an individual bank failure threatened to provoke a wider contagion of bank runs – in the process nullifying everything Powell said in hopes of stabilizing the relentless bank selloff, Yellen now plans to tell US lawmakers that regulators would be prepared for further steps to protect deposits if warranted, in new language that differs from her prepared remarks to the Senate a day earlier.

What started as a market-wide push higher by more than 2% yesterday ended in the indices barely finishing green – usually a pessimistic sign that a rally doesn’t really have the legs it may look like.

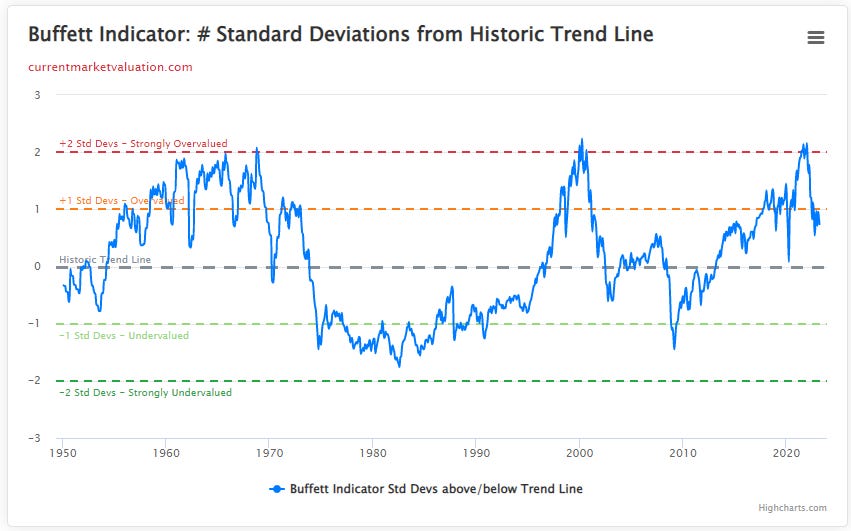

Those familiar with volatile markets know that sharp intraday reversals are usually great gauges of sentiment. To me, yesterday was proof positive that, despite whatever the Fed and Janet Yellen say, reality for this market has to be lower before it goes higher. We still remain one standard deviation above the historical trendline and tech, the saving grace of the market while banks are collapsing, still trades at an insane multiple (the QQQ is at about 28x earnings).

As I have been saying for a week now, the collapses and excess in the banking system aren’t done – and I think it’s likely that new issues in new areas of the market begin to rear their head. For example, both Jim Chanos and Zero Hedge (two opinions I respect) have been extremely critical of commercial real estate.

Which shoe drops isn’t as important as the fact that a next shoe to drop is definitely coming, in my opinion. And while rate pauses and pivots are still the discussion du jour regarding the Fed, we have a lot of sewage that needs to make its way through the plumbing of the economic system first before (1) the Fed hurriedly cuts and (2) those cuts actually do anything (they’re on a lag, just like the hikes).

But for now remember that no matter the outlook, the Fed just hiked again, in what could be described only as an extremely hawkish case scenario on Wednesday wherein Powell ended his Q&A by simply saying “rate cuts are not in our base scenario”.

So neither the market nor the Fed has really panicked yet. But they both will, in my opinion. On Friday, Deutsche Bank shares are down about 10% and swaps on the firm are spiking. So where do markets go from here? (READ THIS FULL NOTE HERE).

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link