Gold pushes back over the $2000 level in early trading

The Silver Institute says silver market is in a new era of structural deficits

(USAGOLD – 4/20/2023) – Gold pushed over the $2000 level once a gain this morning in an attempt to regain momentum after the sell-off of the past couple of days. It is up $13 at $2009.50. Silver is up 7¢ at $25.44. The Silver Institute says that the silver market is in a new era of structural deficits as demand reached a record 1.242 billion ounces in 2022. It forecasts a continuation of both trends in 2023.

“This year is expected to be another of solid silver demand,” it says in its World Silver Survey released yesterday. “Industrial fabrication should reach an all-time high, boosted by continued gains in the P.V. market and healthy offtake from other industrial segments. Although bar & coin demand and jewelry fabrication are expected to fall short of last year’s exceptional levels, both are forecast to remain historically high.…Adding up the supply shortfalls of 2021-2023, global silver inventories by the end of this year will have fallen by 430.9 Moz from their end-2020 peak. To put this into perspective, it is equivalent to more than half of this year’s forecasted annual mine production, and more than half of the inventories presently held in London vaults offering custodian services.”

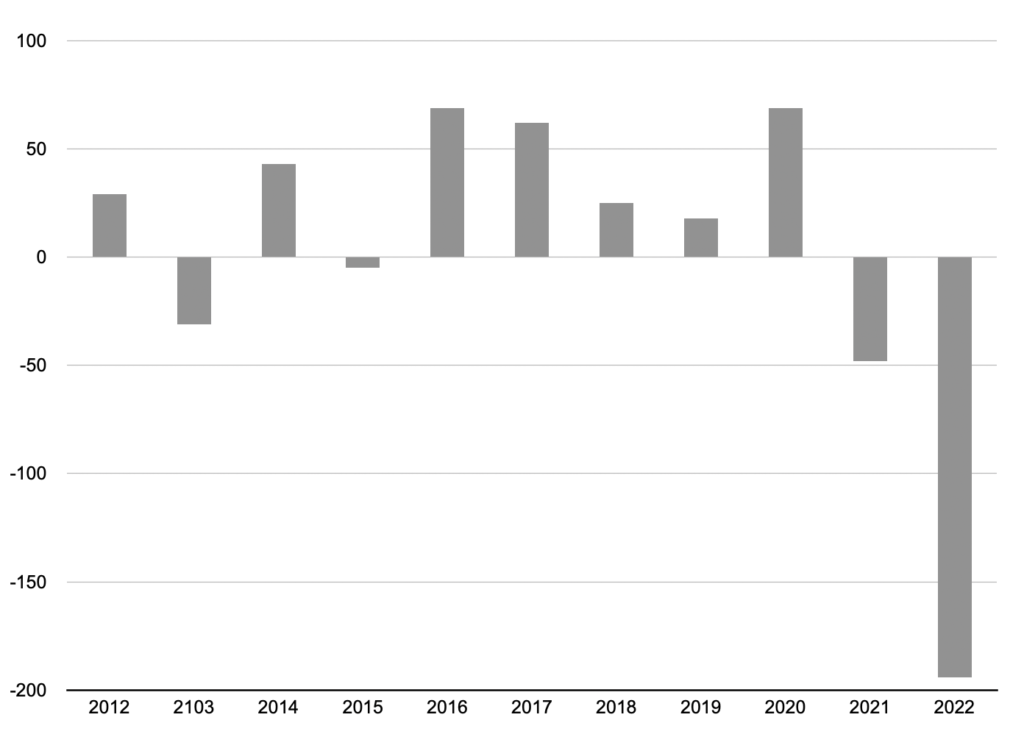

Silver supply surpluses and deficits

(2012-2022)

Chart by USAGOLD [All rights reserved], Data source: Macrotrends.net