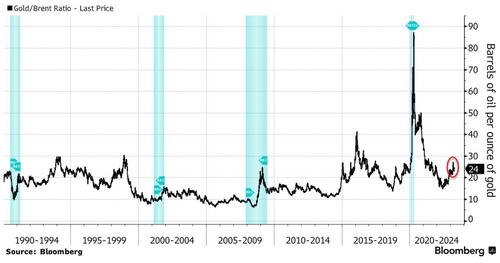

Commodities Bellwether Flashes US Recession Warning

Authored by Bloomberg’s Nour Al Ali,

The commodities market’s bellwether for recessions is flashing a warning sign.

As uncertainty circles the markets on whether the Fed is approaching the end of its tightening cycle, the gold-to-oil ratio suggests commodities traders are hedging against the risk of a US recession.

With oil prices down this year while gold is up, the ratio has surged to almost 24, compared with an average of less than 17 since 2000.

Anything significantly above that average is considered as a warning sign by some market participants.

The performance of gold and oil relative to each other is a measure of investor sentiment on the economy, as both assets are cyclical and priced in dollars.

Historically, gold tends to outperform oil during the onset of a recession or great economic uncertainty.

We’ve seen this trend during the global financial crisis, the recession of the early 1990s, and even in what’s known as the mini-recession of 2015-16, though that was due to Saudi Arabia’s oil-price war with the US.

Now, uncertainty about the Fed’s interest-rate path and a potential economic downturn will likely see the the ratio increase even further.

Loading…

[ad_2]

Source link