Report: TD Bank Likes The Gold, Looks for New ATH

Yesterday TD Bank put out a note detailing a new macro long position in Gold and their rationale

Authored by Goldfix, ZH Edit

Gold is overbought. There’s no gentle way to say it. This was discussed on Sunday with the Founders group (recording available to premium subscribers here). The spike higher and reversal when Shanghai reopened also warned of it as did TD’s CoT analysis this week. These are short term metrics however. From a macro perspective, there may be a lot more dry powder waiting for a reason to get long than usual.

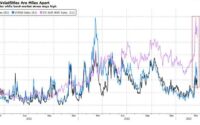

CTA Money is Very Long Gold , But Very Profitable Thus Far…

Multiple banks had been pitching the idea that investors were underinvested in Gold and that if they only stepped in soon, Gold could rocket higher. While it has real risks–such as if Bank buying reversed (Hello Russia), or if the Fed hiked again–there is nothing wrong with that idea

In fact, TD Bank is putting their money where their mouth is. They think the selloff is going to be short lived; and they think current longs in the market are a lot more patient than usual. They longed Gold at $1994 with a $2150 target and a $1900 stop-loss, essentially risking 1 to make 1.5. They bought gold thinking this selloff is a dip to buy.

From that report:

We [are] long active gold at $1994/oz, anticipating imminent selling exhaustion in precious metals and rising discretionary interest to support the yellow metal towards new all-time highs.

(Report at bottom with more GF analysis)

The bank’s positioning analytics argue that selling-exhaustion in precious metals could be imminent and that fresh CTA momentum type liquidation selling does not seem to be nearby. They base this off CTA positioning showing algos being long, but also significantly in-the-money. Therefore they are not likely to be fearful or stopped out on smaller moves lower.

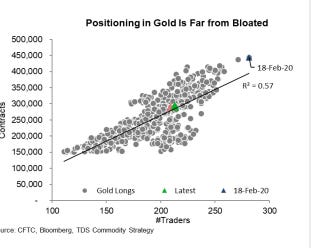

The bar for algorithmic liquidations in gold to pressure prices is elevated, whereas Shanghai trader length is nearing year-to-date lows. Further, dry-powder analysis highlights that position sizing for gold bulls remains near average levels, which points to less pain associated with the recent pullback.

They also believe, as do many other banks of late, that this is an underinvested rally by your normal buy and hold type investors.

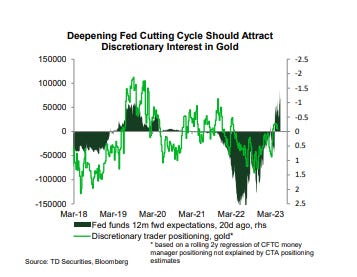

Our gauge of discretionary trader positioning continues to suggest that this cohort has yet to participate in the precious metals rally.

Macro and Investor Fund positioning is significantly lower than historical averages at these prices..

Looking forward, they expect discretionary capital to flow towards gold given strong historical linkages with market expectations for a deepening Fed cutting cycle over the next year.

While it is true the market is handicapping Fed easing starting in November of this year, and this will no doubt put a strong tailwind behind gold (just as it put a killer headwind on metals starting when the Fed started hiking March 2022) — we would note TD’s approach is likely to take some pain first.

Gold Supported by Geopolitical and Domestic Risks despite Monetary Headwinds..

The market has been pretty poor in handicapping Fed behavior of late. Moreso, Fed behavior can and will give a push if they ease, but thus far, it has been Geopolitical and domestic fiscal crises underpinning rallies.

If The Fed Starts Cutting, Stars Could Align…

They believe Gold prices may well be near all-time highs, but the positioning set-up remains inconsistent with a cycle peak.

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link