Will the US Default on Its Debt? — Part Two

The debt ceiling is really a political football rather than a serious macroeconomic policy tool. In the end, Congress always approves the ceiling increases. In a way, the debt ceiling debate is all for show.

What is the debt ceiling?

It’s a numeric limit on the total debt that the US Treasury is allowed to issue. There’s no debt ceiling in the US Constitution. Instead, it’s imposed by statute.

There’s no legal requirement for that statute. The debt ceiling could be repealed by Congress, at which point there would be no limit on the size of the national debt.

Still, Congress likes the idea of a debt ceiling. It forces the White House and Treasury to come back to Congress from time to time to request increases as needed. This gives Congress some leverage to ask for political concessions in return for raising the debt ceiling.

So, the debt ceiling is really a political football rather than a serious macroeconomic policy tool. In the end, Congress always approves the ceiling increases. In a way, the debt ceiling debate is all for show.

To be clear, the debt ceiling does not mean the Treasury cannot issue any new debt. It means that Treasury cannot issue debt that increases the total outstanding above the ceiling.

Getting around the debt ceiling — a shell game of dodgy options

Treasury is at the ceiling now.

The US is still running deficits. How are the new deficits being financed? The Treasury has to resort to ‘extraordinary measures’ to keep paying the bills. Let’s look at some of their options.

The Treasury has several slush funds, such as the Exchange Stabilisation Fund, that it can tap into to pay bills without Congressional approval. Believe it or not, the Treasury sometimes has positive cash flow even though the deficit is increasing. This happens around this time of year when more Americans are paying their taxes than are claiming refunds.

This positive cash flow can help the Treasury pay bills temporarily, even if a dry spell emerges late in the year. (This typically happens in the summer when tax payments slow down and ‘use it or lose it’ spending increases.) Finally, the Treasury can sell assets (Grand Canyon, anyone?) to put some cash in the till.

A trillion-dollar coin?

You may have heard of the trillion-dollar coin idea. It won’t happen, but here’s how it works.

The Treasury would ask the US mint to produce a solid platinum coin. The Treasury would give the coin to the Federal Reserve and simply declare that the coin was worth US$1 trillion. (Assuming it to be a one-ounce coin, the actual market price is about US$1,000.)

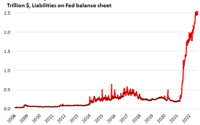

The Fed would put the coin in a vault and credit the US Treasury general account US$1 trillion. The Treasury could spend that newly printed money as it wished. The Treasury would not violate the debt ceiling because no new debt would be issued; the Fed would just create the dollars out of thin air. Easy breezy.

Of course, the trillion-dollar coin policy would be disastrous. The arbitrary valuation of the coin would show the true Ponzi nature of the Treasury market today. Fed efforts to supply the cash would radically increase the money supply and probably trigger more inflation. The Fed and Treasury would be laughingstocks.

That’s dangerous for two institutions that rely on public confidence to do their business. Only the simpletons in financial media believe this idea is worth discussing, but it’s good to understand it because you will be hearing more about it.

Revaluing gold?

There is another version of the trillion-dollar coin that is actually legal, is not hard to defend, and has been used in the past during the Eisenhower Administration.

In the 1930s, President Roosevelt ordered the gold held by regional Federal Reserve Banks to be transferred to the US Treasury. The regional Fed banks are privately owned, and the Treasury is an arm of the government. The Fifth Amendment to the Constitution requires that no ‘private property be taken for public use, without just compensation’. This requires the Treasury to compensate the Fed for the confiscated gold.

The Treasury’s solution was to give the Fed a ‘gold certificate’ in exchange for physical gold. That certificate is still an asset on the Fed’s balance sheet.

Here’s the catch. The certificate values the gold at about US$42 per ounce. The market value of gold today is about US$1,830. How much gold is involved? About 8,000 metric tonnes; almost exactly the amount of gold the Treasury holds in Fort Knox and West Point.

The Treasury can then call the Fed and ask them to revalue the existing gold certificate to US$1,830 per ounce and credit the gains to the Treasury general account. The gold certificate is currently worth about US$10.8 billion. At the revalued price, it would be worth US$470 billion.

The gain of US$459.2 billion would be in the Treasury’s account at the Fed. That’s enough to pay the government’s bills for about six months at current baseline rates.

The difference between the trillion-dollar coin and the gold certificate revaluation is that the coin involves a fake valuation, whereas gold involves a true valuation of current market values.

Also, the gold behind the certificate actually exists, and the gold revaluation method was used in the past, including during the Eisenhower Administration.

That said, the gold revaluation method will not be used, either. The reason is that neither the Treasury nor the Fed wants to call attention to the fact that the Treasury has the gold and that the gold certificate even exists.

No one in government wants to treat gold as a monetary asset because that would undermine confidence in the paper money Ponzi the US has been running since 1968. (That was the last year Fed money printing was constrained by the requirement to tie money supply to a fixed quantity of physical gold held by the Treasury. The so-called ‘gold cover’ ratio was one more victim of Vietnam War spending.)

Prioritisation?

Another technique favoured by some Republicans and rejected by Democrats and the White House is called ‘prioritisation’. In this scenario, Treasury would pay critical bills such as interest on the national debt, Social Security, and Medicare but would defer payment on other bills, such as defence contractors and non-essential workers who could be put on unpaid leave.

The defence contractors might get scrip in the form of ‘due bills’, basically an unsecured IOU, but not Treasury debt in the strict sense. When the debt ceiling issue is resolved, contractors could present the due bills and get cash. This method is admittedly a bit messy, but it could work.

Default?

Don’t buy into the claim that the US has ‘never’ defaulted on its debt. We do it all the time. In 1933, FDR devalued the dollar against gold, invalidated ‘gold clauses’ in contracts (a way to guarantee the value of a dollar by converting it into a weight of gold), and made gold itself contraband. From 1977–1981, the US dollar lost 50% of its purchasing power during the great inflation of those years.

Devaluation and inflation are just different ways to default because you receive payment in dollars that are not worth anything close to what you expected or bargained for.

US Treasury notes held by the Central Bank of Russia are now frozen and unavailable to the Russians. What is that but a default? The US offers a continuing master class on various ways to default.

Approaching the X-Date

How long can this shell game go on? No one knows exactly. There are estimates that are referred to as the ‘X-Date’. That’s the day the Treasury really does run out of cash and can’t pay bills or pay off Treasury note holders. Right now, the X-Date is estimated to be around 5 June 2023, but even that is a guess. The real X-Date will depend on how much positive cash flow the Treasury generates during tax season around mid-April.

What do Republicans in the House want in exchange for raising the debt ceiling? Here’s a short list:

- Debt-to-GDP targets

- Caps on discretionary spending (excludes entitlements)

- Rollback of regulations

- Spending rescissions, including US$155 billion of unused COVID relief

- Easier permitting on energy exploration and production

- Prioritisation (bondholders, veterans, and entitlements are guaranteed)

It’s easy to see how this list of concessions would help Republicans, not only in the short run, but in all future debt ceiling battles. In particular, debt-to-GDP targets would act as a kind of debt ceiling (depending on growth) independent of the debt ceiling statute. Prioritisation would take away the scare tactics of bond default and Social Security recipients not getting their cheques.

With these tools in place, Republicans would gain the upper hand in future debt and deficit battles with the White House.

Naturally, the White House rejects all these provisions and demands a ‘clean’ debt ceiling raise with no strings attached.

All the best,

|

Jim Rickards,

Strategist, The Daily Reckoning Australia

This content was originally published by Jim Rickards’ Strategic Intelligence Australia, a financial advisory newsletter designed to help you protect your wealth and potentially profit from unseen world events. Learn more here.

[ad_2]

Source link