Watch Pozsar: Dedollarization is Accelerating

Little coverage was given this conversation. We feel that was a mistake as Pozsar again gave us the answer key to the next 12 months.

Authored by GoldFix

UPDATE: With the recent escalation in talk of dedollarization and the differing opinions swirling around what is a Global reserve currency, we decided to unlock this post. Pozsar, in a very candid interview with an unaware Bitcoin-focused audience, details not only how dedollarization occurs, but announces that we are in the Anteroom of YCC, and therefore Financial repression. Section 6 is the dedollarization section, right before the bitcoin comments.

Strong recommendation to watch and follow along by topic if you are inclined

Interview Topics

- Banking Crisis

- QE Restarting

- Inflation, Volcker, and Powell

- Food/Energy Will Make Fed Keep Hiking

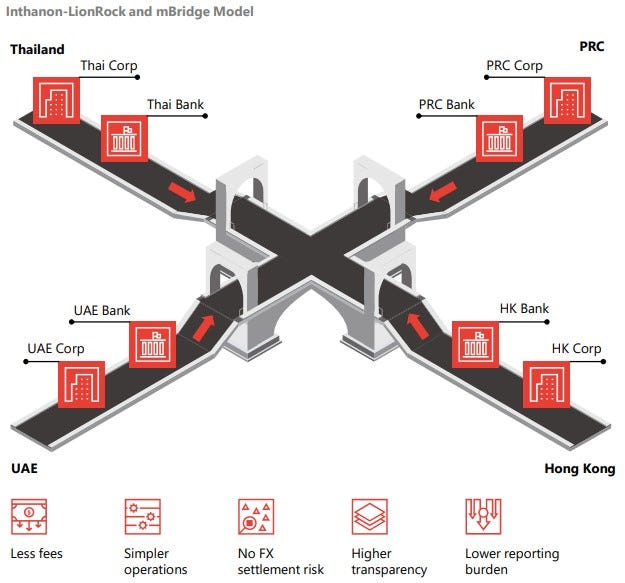

- BRICS vs G7 on CBDC Use

- Dedollarization Plumbing Explained

- Bitcoin

‘I told my friend (who had gotten a great mortgage from FRC, “The next time you get a mortgage that’s too good to be true, short the bank stock that gave it to you”’

It was small-bank specific and a function of inexperienced risk mgt (SVB, FRC) and lopsided tech depositor base (SVB)

The BTFP was an impressive reaction to contain the crisis, and it is a kind of “foaming the runway for any of the large banks having problems down the road”

One thing not yet tapped is the RRP, which functions as money in the mattress not needed by any financial institution yet. Implicitly if that is tapped and if the bigger banks like JPM choose to draw that down instead of collecting 5% interest as they currently are, then you know the problem is spreading. This sounds like next funding problem, if one happens, the Fed will tell them to tap it

Hayes: Do you think the behavior of Gold and BTC are ‘seeing through’ these BTFP funding programs as highly inflationary?

Pozsar: Yes… (head nodding)

These Fed vehicles just created to rescue banks’ nonperforming assets have the same effect as QE/YCC despite their technical differences. These facilities tamp down longer term rates much in the same way as YCC does though not as obviously. We are in the “anteroom” for the next QE By keeping bad loans from hitting the free market’s Yield Curve they force money seeking proper yield to go elsewhere. This is inflationary.

GoldFix from April 1st, The Bank Bailout is YCC

By lending to banks at face value for bonds/securities underwater by 30 to 60%, you remove the necessity for the banks to liquidate said securities in an open market to raise cash. Doing so removes upward pressure on interest rates that would by necessity occur from a fire-sale of these securities. You keep rates down.

Financial Repression is when you use tools to skew issuance of treasuries towards the front end of the curve while keeping longer term yields low artificially. This migrates to the dollar itself and buying power gets killed. “There are many tell-tale signs here, you know…” of financial repression and YCC getting ready to happen. Meanwhile, as long as short term rates keep climbing, problems will continue to bubble up.

Herodotus said “Circumstances rule men. Men do not rule circumstances”.-describing the difference between Volcker and Powell

Volcker’s circumstances were significantly different than Powell’s are. Volcker raised rates sure, but commodity supply was already coming back on line in reaction to the 1970s oil crisis, the labor force was growing from women joining, Unions were weakened by Reagan, inflation indexing was on the way out.

Today, under Powell the exact opposite of everything under Volcker is occurring: Commodity shortages, Labor shortages, Equity redistribution is just getting started from Capital to Labor.

The Fed is looking closely at real interest rate relationships in a spot-versus-forward sense. Right now real rates are positive in a forward sense, but not spot. They are waiting for that tipping point to hit up. Until positive real rates take hold in a spot sense, there will be no easing if they can help it. “Definitely no cuts [in 2023], a pause is not a cut”. They are waiting to see how BTFP gets used to handle next problems cropping up.

“Can oil go from here to $150.. Likely. If it does what does that mean to the Fed— Nothing good because they have to respond.”

A lot of non-linear events created this inflation. The Pandemic, the response both fiscally and monetarily, the war and geopolitics. But the things that will likely force the Fed hands now are a re-spike in goods inflation. Specifically food and energy are not in Fed control, and if they start accelerating with Services inflation still too high, The Fed will have to unpause.

The Fed has almost no control over goods inflation since US goods are mostly imported. Rate hikes may slow demand, but they don’t necessarily drop prices if the goods are in short supply and others want themService inflation however they were supposed to get lower much quicker. In this way, the Fed knows they’re very vulnerable to goods inflation resurging, especially if its due to another non-linear “shock” type event

Over the past 12 months the RMB has gone from 1% trade financing to 5%… in 12 months! The Euro is about 8% over 15-20 years of existence…

The BRICS and the G7 view digital currencies differently in their use case. BRICS gov’ts view them as a tool to do local bilateral commodity trade and get off the dollar for those. CBDC are on the surface a means to transact trade internationally in a mercantilist type environment.

The G7 cannot claim that use case ( in truth or even as a marketing ploy) to get them adopted. Therefore the West can only cite CBDC usefulness in ways that makes them a threat to freedom rather than an opportunity to get off the Dollar.

Expect the West to create its own CBDC for int’l trade when/if the BRICS are successful and after the Ukraine war winds down.

It’s all going to be at the expense of the dollar share of assets.

Continues here no paywall

Free Posts To Your Mailbox

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

Loading…

[ad_2]

Source link