The Fed’s Emergency Liquidity Program, BTFP, is Over $100 Billion, What’s Going On? – MishTalk

I was asked about the Bank Term Funding Program (BTFP) to provide Liquidity to Depository Institutions. Let’s check it out.

What is the BTFP?

The St. Louis Fed says the Bank Term Funding Program Provides Liquidity to Depository Institutions

On March 12, the Federal Reserve launched the Bank Term Funding Program (BTFP), a lending program for eligible depository institutions—banks, savings banks and credit unions—experiencing liquidity issues. The goals of the BTFP are to bolster institutions’ capacity to safeguard deposits and ensure the ongoing provision of credit to communities and the broader economy.

Use of the BTFP reduces the need for an institution to quickly sell securities, perhaps at a loss, in times of stress.

The Fed started the BTFP program in the wake of the collapse of Silicon Valley Bank.

Small regional banks overleveraged in long term treasuries and were clobbered by paper losses and then bank runs.

In response, the Fed agreed to shield the banks from losses by offering swaps at par value, ignoring the losses.

BTFP Terms

- Eligible Collateral—Direct obligations of certain U.S. government agencies, including the U.S. Department of the Treasury, government-sponsored enterprises such as Fannie Mae and Freddie Mac, and the Federal Home Loan Banks. In addition, mortgage-backed securities issued and/or fully guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac are eligible.

- Loan Terms—Institutions may borrow up to the value of eligible collateral pledged. Collateral is valued at par, i.e., with no haircuts. Loans can be prepaid at any time without penalty. The rate is fixed for the life of the loan (up to one year) and is calculated by adding 10 basis points to the overnight index swap rate. The rate is published daily on the Discount Window website. Advances will be available until March 11, 2024, or longer if the program is extended.

How is Collateral Valued?

The collateral valuation will be par value or equal to the outstanding face amount. Margin will be 100% of par value. There will be no haircuts applied.

Fed’s Balance Sheet

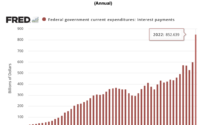

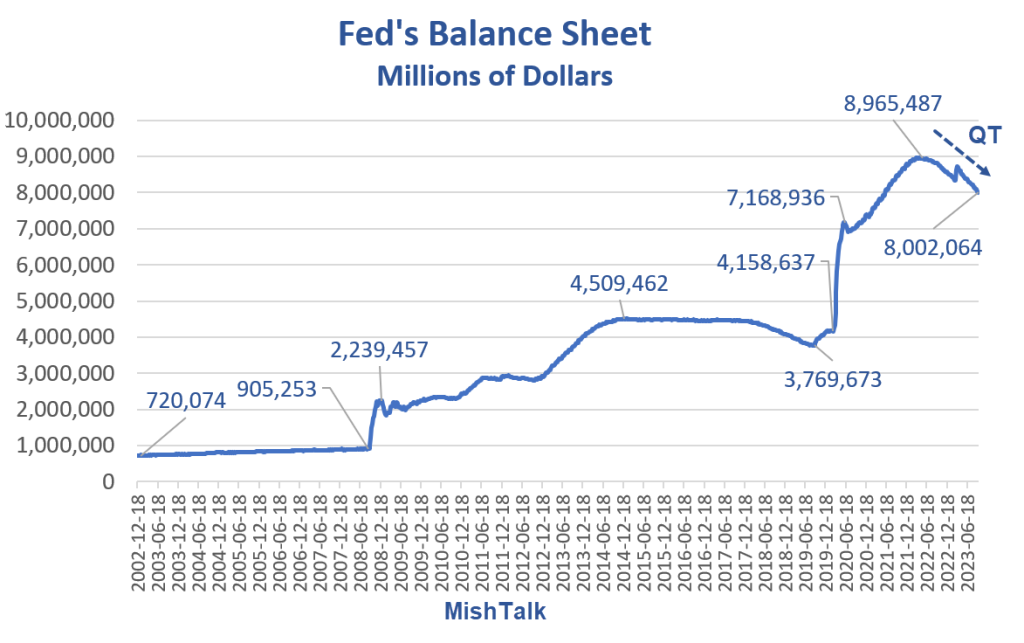

To put the things into proper perspective, the Fed’s balance sheet still over $8 trillion, down from $8.97 trillion on April 13, 2022.

This reduction of the Fed’s Balance Sheet on published schedules is called Quantitative Tightening (QT) and is going according to planned schedule for Treasuries but not Mortgage Backed Securities.

The BTFP is about $108 billion with a small increase since June of 2023.

Hiding Losses

Banks that needed to hide unrealized losses have mostly already done so.

Losses on Treasuries is a problem of the Fed’s making by encouraging speculation for over a decade. Topping it off, Quantitative Easing (QE) more than doubled since 2020.

Liquidity, Not Solvency Issue

This is a liquidity issue, not a solvency issue. The US is not going to default and the treasuries are not worthless. The Fed wanted to stop bank runs and did so by a method that hides losses.

However, the paper losses are still real, even if hidden in reports. This has an impact on banks willingness to make loans in a rising interest rate environment.

Small Business Bankruptcies Surge in 2023, Five Reasons Why

Meanwhile Small Business Bankruptcies Surge in 2023.

Nearly 1,500 small businesses filed for Subchapter V bankruptcy this year through Sept. 28, nearly as many as in all of 2022, according to the American Bankruptcy Institute.

The Fed can paper over bank losses on Treasuries and mortgages, but it cannot do anything about realized losses on bankruptcies and commercial real estate.

That is where the big problems remain.

[ad_2]

Source link