Some big Wall Street banks are expecting next week’s refunding announcement by the Treasury to reflect the government’s large and ongoing borrowing needs.

JPMorgan Chase

JPM,

and Deutsche Bank

DB,

estimate that Treasury will need to borrow roughly $1.5 trillion during the current fourth quarter and first quarter of 2024 — on top of the $1 trillion estimated borrowing that took place in the third quarter. Jefferies

JEF,

puts the number closer to $1.4 trillion.

Treasury’s heavy borrowing is one of the most important factors behind the recent, steep run-up in long-term yields, which ended the New York session at their highest levels since 2007 last week. Since July, 10-

BX:TMUBMUSD10Y

and 30-year yields

BX:TMUBMUSD30Y

have each jumped by a full percentage point or more as traders fret over the onslaught of supply for Treasurys, the U.S. government’s fiscal trajectory, and the risks of holding long-dated government debt to maturity.

“We do expect the Treasury to be responsive to the recent market move,” said Deutsche Bank strategist Steven Zeng in a note.

Deutsche Bank’s forecast calls for a slight moderation of increases in 10- to 30-year maturities relative to the last refunding quarter. Still, Zeng said his bank expects Treasury to announce $749 billion of borrowing for the fourth quarter and $822 billion for the first quarter of 2024.

Meanwhile, JPMorgan anticipates that Treasury will announce $800 billion in net marketable borrowing for the October-December period, and $698 billion for January-March of 2024, according to strategist Jay Barry and others.

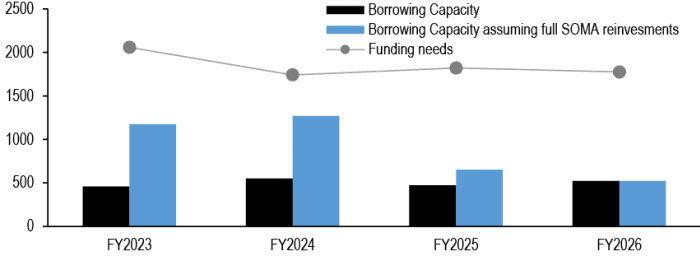

“Given this backdrop, Treasury’s current auction schedule is insufficient to meet its prospective financing needs,” the JPMorgan team wrote in a note this week. The “funding gap remains large in the coming years,” even after last quarter’s increases.

Sources: U.S. Treasury, Congressional Budget Office, JPMorgan

“Over the near term, Treasury will continue to lean on T-bills to bridge this gap, as it did in fiscal year 2023, but this is unsustainable, as the T-bill share of debt is likely to rise toward 22% by year-end 2023, and also given large projected financing needs in fiscal year 2024 and beyond,” according to the JPMorgan note.

Treasury is set to kick off the quarterly refunding process on Monday. The department’s round of announcements includes details on upcoming auction sizes on Wednesday, which BMO Capital Markets strategists Ian Lyngen and Ben Jeffery said will “readily overshadow” the Federal Reserve’s policy update that same day.

On Friday, Treasury yields ended little changed to slightly lower after the Fed’s preferred inflation gauge reflected both good and bad developments. Meanwhile, U.S. stocks

DJIA

SPX

COMP

closed mostly lower, with the Dow Jones Industrial Average and S&P 500 experiencing another day of losses.