Fade Away! US Commercial Real Estate (CRE) Falls To 5% Of Entire S&P 500 Index From 14% In 2008, The Flaw With The 30 Year Fixed-rate Mortgage – Confounded Interest – Anthony B. Sanders

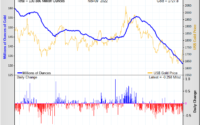

Commercial real estate (CRE) is fading away as a component of the S&P 500.

The S&P 500 real estate sector is now just 5% of the entire S&P 500.

Even at the 2008 low, in the worst real estate crisis of all time, this percentage barely dropped below 6%. Meanwhile, demand for commercial real estate (CRE) loans is now at 2008 levels.

Office building prices are down ~30% over the last year and apartments are down ~15%.

Also, Delinquent commercial real estate loans at US banks have hit their highest level in a decade.

The strength of the housing market is masking the weakness of CRE.

Speaking of the housing market, the US is overly dependent on the lopsided 30-year fixed-rate mortgage. Where under inflation and rising rate, the lender (investor) loses. If inflation cools and rates fall, the borrower refinances.

Here is my US House of Representatives testimony of 30 year mortgages. Here is the actual paper by Michael Lea and me.

But these consumer benefits to the 30-year mortgage have costs. It is costly to provide a fixed nominal interest rate for as long as 30 years. And the prepayment option creates significant costs. If rates rise, the lender has a below market rate asset on its books. If rates fall, the lender again loses as the mortgage is replaced by another with a lower interest rate. To compensate for this risk, lenders incorporate a premium in mortgage rates that all borrowers pay regardless of whether they benefit from refinance. Exercise of the prepayment option in the contract also has significant transactions costs for the borrower and imposes additional operating costs on the mortgage industry.

Another major reason for the FRM’s dominance is government support and regulatory favoritism. The FRM is subsidized through the securitization activities of Fannie Mae, Freddie Mac and Ginnie Mae.

Their securities benefit from a government guarantee that lowers the relative cost of the instrument, which is their core product. These guarantees have a significant cost as the government backing of Fannie Mae and Freddie Mac has exposed taxpayers to large losses.

Are the FRM’s benefits worth its costs? Would the FRM disappear if Fannie and Freddie stopped

financing it? Are there mortgage alternatives that balance the needs of consumers and investors without exposing the taxpayer to inordinate risk?

The instrument’s supporters point out that it is easier for investors than consumers to manage interest-rate risk. It is true that lenders and investors have more tools at their disposal to manage interest-rate risk. But managing prepayment risk is costly and difficult and many institutions have suffered significant losses as a result (e.g., savings and loans in the 1980s; hedge funds and mortgage companies in the 1990s and 2000s).

Furthermore, borrowers rarely stay in the same home or keep the same mortgage for 15 to 30

years, so one can reasonably ask why rates should be fixed for such long periods (increasing the loan’s cost and risk). Also, the taxpayer ultimately bears a significant portion of the risk through support of Fannie Mae and Freddie Mac.

One of the lingering questions about government loan modification programs is why borrowers are refinanced into longer-term FRMs rather than less expensive ARMs, such as a 5/1 ARM.

ARMs allow protection for lenders (investors) from inflation and interest rate increases. Consider this another entitlement that elected officials give away and refuse to cut. After all, unfunded entitlements are already at $211.65 TRILLION.

But typically we get scare tactics about ARMs (or VRMs), like this one.

[ad_2]

Source link