Fed’s Barr Signals Emergency Loan Program Won’t Be Extended

(Bloomberg) — The Federal Reserve’s top bank watchdog signaled that the central bank is unlikely to extend an emergency loan program that it started last year during the regional banking crisis.

Most Read from Bloomberg

Michael Barr, the Fed’s vice chair for supervision, said during an event in Washington that the Fed’s Bank Term Funding Program had functioned as intended to ease stress in the financial system. The temporary program is set to expire on March 11.

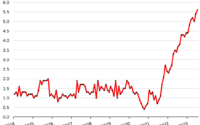

The program allows banks and credit unions to borrow funds for as long as one year. Banks have tapped the backstop for a record amount of funds in recent weeks as expectations that the Fed will cut interest rates as soon as March have made it a more attractive choice.

Speaking at an event hosted by the Women in Housing and Finance group, Barr repeatedly said that the program had been designed for an “emergency situation.” He added that he expected borrowing to continue until March 11.

During the session, Barr was also asked about US regulators’ plan to increase capital requirements for Wall Street’s biggest banks. He was questioned specifically about the plan’s impact on consumers’ access to credit and affordable mortgages. In response, he said that officials were weighing comment letters and indicated that he was open to considering changes.

Read More: Fed’s Michael Barr Is Open to Concessions on Bank Capital Rules

–With assistance from Rachel Evans and Alexandra Harris.

(Updates with Barr comments in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

[ad_2]

Source link