Banks Tightening Consumer Credit May Be What Triggers Recession

By Vincent Cignarella, Bloomberg Markets Live reporter and strategist

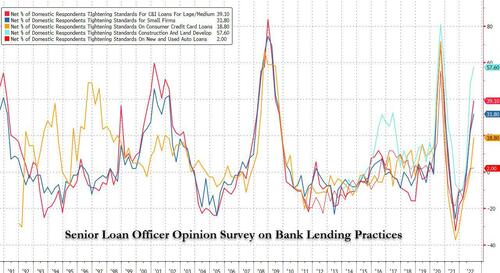

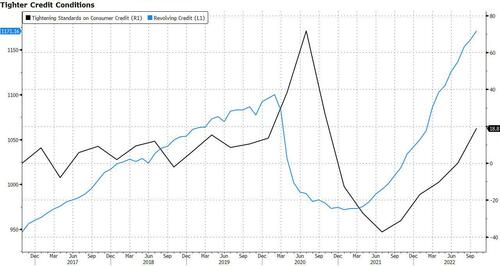

A surge in revolving credit has not gone unnoticed by lenders. The Fed’s Senior Loan Officer Opinion Survey on bank lending practices showed banks tightening lending standards for commercial, mortgage, and credit card loans.

Tighter credit likely will drive slower spending, a reduction in risk and the potential for the Fed to pivot sooner rather than later to avoid or shorten a potential recession. That would be more good news for bond bulls.

The tightening standards are a result of most banks assigning the probability of between 40% and 80% to the likelihood of a recession in the next 12 months, with no bank reporting a probability less than 20%. The next report on revolving credit is scheduled for Feb. 7.

For risk, in particular the US Treasury market is something to watch. Any slowdown in spending would give the current bid in fixed income yet another boost.

Loading…

[ad_2]

Source link