MoneyWeek/John Stepek/3-28-2022

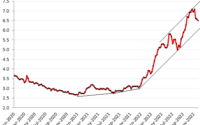

“To take one measure cited by FT Alphaville, the Bloomberg Global Aggregate bond market index has fallen by more than 11% since its peak in January 2021, which is ‘the biggest setback since at least 1990’. Yes, I realise that for those of you who focus on equities, that doesn’t sound like a big deal. Sometimes equities can lose that in a week, and you just have to suck it up. But believe us, this is a big deal for bonds.”

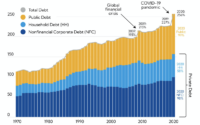

USAGOLD note: Stepek agrees with something we alluded to earlier this week: “I suspect this is just a preview of the wrestling match that central banks in the US, the UK (and the eurozone) are about to face too.” He thinks a solution would be for all to weaken their currencies at the same pace – something that “is good for gold in the long run.”