MarketWatch/Joseph Adinolfi/9-17-2022

“With the Fed doubling the pace at which its bond holdings will “roll off” its balance sheet in September, some bankers and institutional traders are worried that already-thinning liquidity in the Treasury market could set the stage for an economic catastrophe — or, falling short of that, involve a host of other drawbacks.”

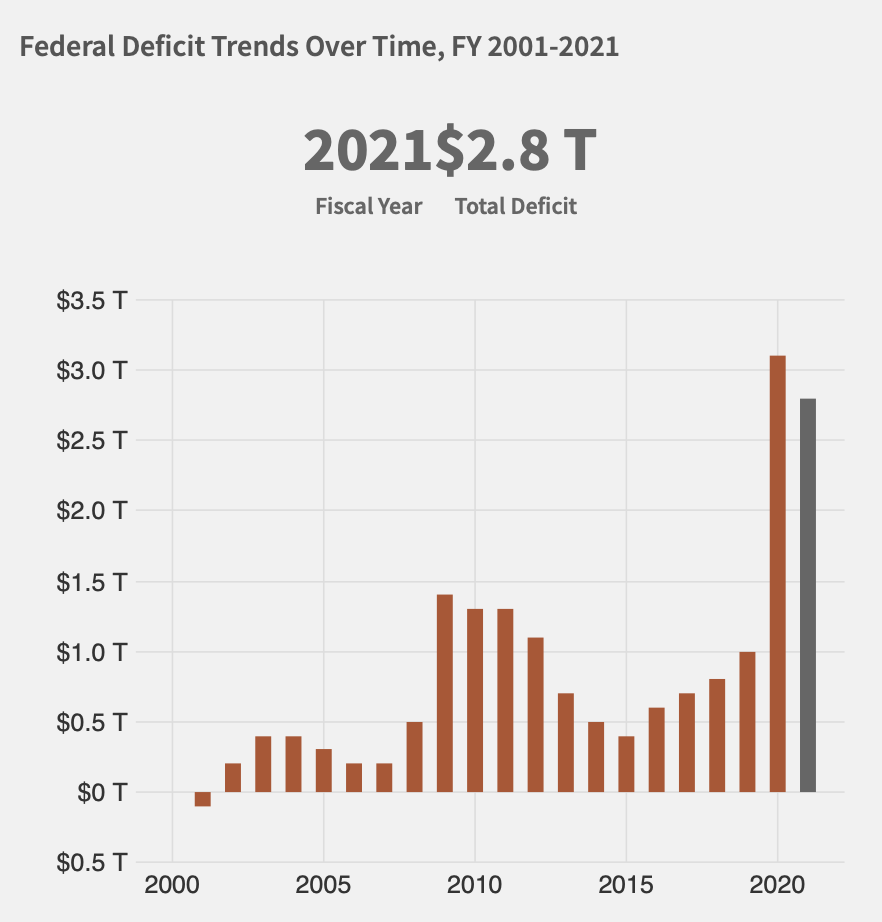

USAGOLD note: We’ve worried about a black swan event precipitated by quantitative tightening for quite some time. It’s not just the selling – that’s one thing. It’s also the sudden withdrawal of support for bond issuance from the federal government that worries us. As you probably already know, both China and Japan – the two largest foreign holders of U.S. Treasuries – are out of the market. Though the Congressional Budget Office optimistically projects the borrowing needs of the federal government will decline to $1 trillion in 2022, it still projects a $1.6 trillion shortfall from 2023 through 2032. Consider, too, that revenue usually declines during recessions., while spending ramps up.

Chart courtesy of US. Treasury Department